Financial Experts in Action means acting, not reacting. ValueTrust stands for solution-oriented, independent and partnership-based financial advisory in demanding corporate situations. We work side by side with executives and investors, and accompany you as a trustworthy partner through financial decision-making processes. Working together with you, our aim is to make every effort to achieve sustainable success for your business. We bring passion, maximum commitment and a highly competent team of experts to each and every project.

When it comes to structuring and protecting financial decisions, we are the right partner for you. By conviction.

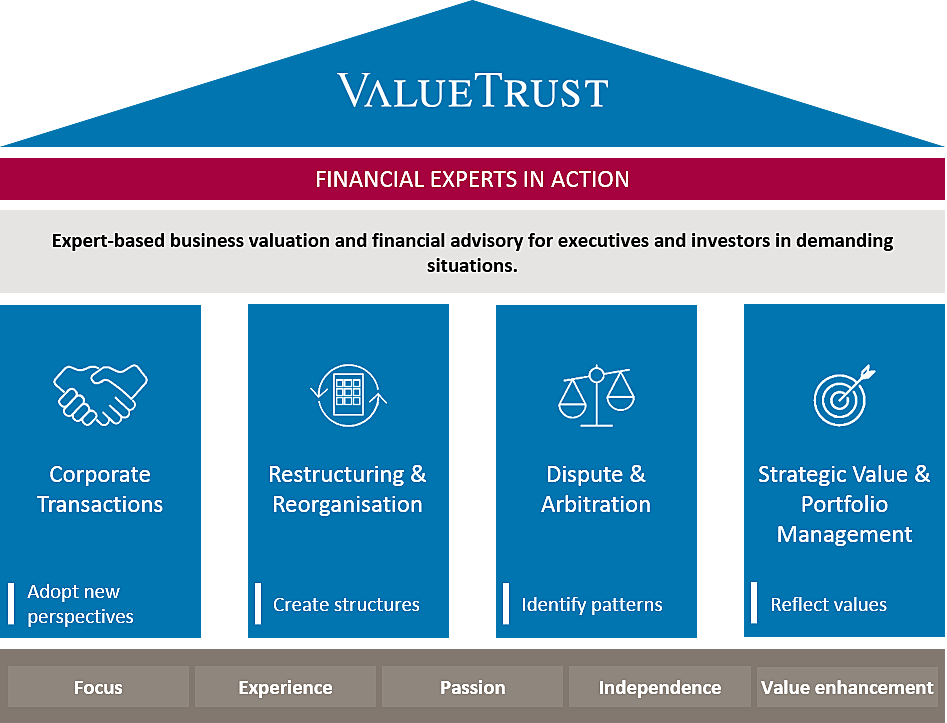

MISSION

Expert-based business valuation and financial advisory for executives and investors in demanding situations. Typical situations where our experience and independence in financial analysis and advice are required include corporate transactions, restructuring and reorganisation, dispute and arbitration, as well as strategic value and portfolio management. We support our clients in an experience-based, partnership-based and independent spirit by clearly focusing on sustainable, practicable solutions that are both theoretically and legally sound.

SELF-CONCEPTION

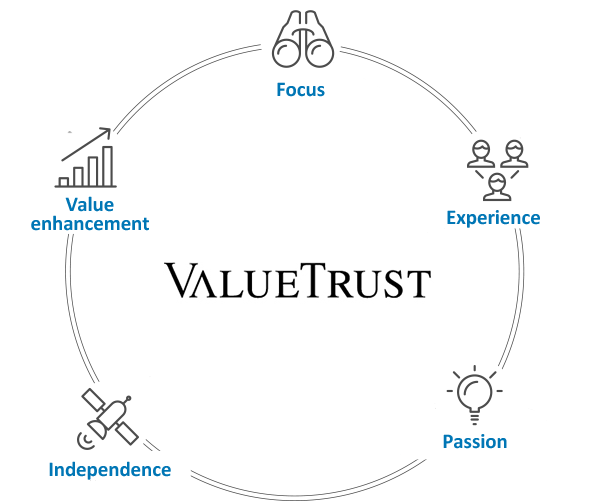

Focus, experience, passion, independence and value enhancement.

Our guiding principles influence everything we do and everyone we work with, both employees and clients. Five principles form the basis for our actions and help us to transform the demanding business situations of our clients into sustainable successes:

FOCUSING IS CRUCIAL.

What distinguishes us is a clear and consistent focus on our clients and their entrepreneurial challenges. But also our own core competencies and the development of a synergetic organizational model. This focus allows us to act efficiently and always achieve maximum and sustainable business success for you.

EXPERIENCE COUNTS.

We are convinced that we can accompany you successfully through all of your challenging business situations. We achieve this by combining many years of expertise, innovative pioneering work and economic intuition. You benefit from a broad, state-of-the-art knowledge base, thanks to close networking with our supervisory and specialist advisory boards and institutions as well as the continuous certification programmes followed by our employees.

PASSION FOR ONE’S OWN WORK.

We turn your entrepreneurial challenges into our own tasks. Our advisory approach is based on the combination of many years of experience and specialist knowledge combined with state-of-the-art methodology. If we decide to take a project on, we work on it with passion, maximum commitment and conviction.

PROVEN INDEPENDENCE.

Our proven independence and ability to react quickly are decisive factors for your success. Our work is not influenced by personal or economic dependencies and our order acceptance is based on clear, results-oriented quality criteria. Since we operate independently of professional associations and their guidelines, we can use existing approaches to maximise customer benefits.

FOCUS ON VALUE ENHANCEMENT.

It is our policy not to accept an assignment until we are convinced that we can solve the challenges of our clients and create sustainable value enhancement. We are convinced of the lasting value of a long-standing, partnership-based relationship between client and consultant. We consider the trusted cooperation both with clients and with our employees to be one of the most important guiding principles for sustainable satisfaction and value enhancement for all.

HISTORY

ValueTrust was founded in 2007 as Value-Trust Financial Advisors GmbH by former employees of KPMG’s Corporate Finance division. From 2007 to mid 2013, ValueTrust was part of the Duff & Phelps group, a leading international consulting firm for financial advisory and investment banking services.

After the takeover by an international private equity consortium and the delisting of Duff & Phelps in spring 2013, ValueTrust separated in summer 2013. Since then, ValueTrust has been managed by former senior employees of KPMG and Duff & Phelps.

PVT Financial Advisors SE currently has offices in Munich, Frankfurt, Zurich and Vienna.

TEAM

The partner at your side: ValueTrust Financial Experts.

- Management

- Supervisory Board & Senior Advisors

Prof. Dr. Christian Aders is Chairman of the Executive Board and Senior Managing Director of PVT Financial Advisors SE in the Munich office and co-founder of ValueTrust. After finishing his PhD in business administration, he was a partner at KPMG’s corporate finance department before he joined Duff & Phelps and ValueTrust to build up their German practices.

Benedikt Brambs is Managing Director and General Manager of ValueTrust Financial Advisors Switzerland AG. After finishing his business administration studies at the Ludwig-Maximilians-University Munich and completing his degree as Accredited Senior Appraiser in Business Valuation, he worked for Ernst & Young and EY-Parthenon prior to joining ValueTrust in 2019.

Dennis Muxfeld is Managing Director in the Munich Office of ValueTrust Financial Advisors. After finishing his business law studies at the Leuphana University Lüneburg and the University of Applied Sciences St. Gallen and completing a Masters in Corporate and Financial Law (LL.M.) from the University of Glasgow (Scotland), he worked for Rödl & Partner, Möhrle Happ Luther and Bayerische Hypo- und Vereinsbank prior to joining ValueTrust in 2014.

Mehmet Özbay is Managing Director and General Manager of ValueTrust Financial Advisors Deutschland GmbH. After finishing his Corporate Finance studies at the University of Cologne and the University of St. Gallen where he completed a Master’s degree, he worked for Duff & Phelps, Lehman Brothers and Sal. Oppenheim prior to joining ValueTrust in 2014.

Christian Haage is Director in the Munich office of ValueTrust. He completed his Bachelor’s degree in Economics at the University of St. Gallen (Switzerland) and his Master’s degree in Finance and Economics at the University of Cambridge (England). Before joining ValueTrust in 2018, he worked in Deal Advisory at KPMG.

Benno Jacke is a Certified Public Accountant („Wirtschaftsprüfer“) and Managing Director of ValueTrust Financial Advisors GmbH Wirtschaftsprüfungsgesellschaft. He is also Head of ValueTrust’s Disputes & Arbitration unit in Frankfurt. Since completing his Bachelor’s degree at the Frankfurt School of Finance & Management and during his part-time Master’s degree at the University of Mannheim with a focus on Accounting & Taxation, he worked for KPMG before joining ValueTrust in October 2017.

Nicolas von Manteuffel is Director in the Munich office of ValueTrust Financial Advisors. He studied business administration at the Berlin School of Economics and Law and at the ESC Rennes School of Business in France and received a Bachelor of Science (B.Sc.) degree, then his Master of Science (M.Sc.) degree. Before joining ValueTrust in 2018, he worked in Deal Advisory at KPMG.

C. Bernt Sannwald is Chairman of the Supervisory Board of ValueTrust Financial Advisors as well as the founder and managing director of Sannwald & Compagnie and advises a broad range of clients in corporate transactions. He has more than 30 years’ experience in providing advice on corporate finance to German and international companies as well as private and public investors.

Michael H. Kramarsch is Vice Chairman of the Supervisory Board of ValueTrust Financial Advisors and Founder, Delegate of the Board and Managing Partner of hkp/// group. He is a leading expert in Value-based Management, Corporate Governance, Performance Management and Board Compensation and – among others – was a named specialty expert for several German regulatory bodies on the German Corporate Governance Code (DCGK). Michael H. Kramarsch is a founding member of the European Center for Board Efficiency and Advisory Board member of the HHL Center for Corporate Governance, Leipzig.

Torsten Krumm is Member of the Supervisory Board of ValueTrust Financial Advisors and Managing Director and Chairman of the Investment Committee at HQ Equita. He has more than 20 years of experience in private equity in Europe. Before joining HQ Equita, Torsten Krumm was a Partner at the private equity firm Odewald & Compagnie in Berlin and Apax Partners in Munich. Mr. Krumm had previously worked for ten years at Intel in Australia and Europe – in his last position as Director at Intel Capital Europe with responsibility for M&A and investments in Europe.

Wolfgang Ballwieser is a Senior Advisor to ValueTrust Financial Advisors as well as professor emeritus at the Munich school of management at the Ludwig-Maximilian University in Munich where he focuses on accounting and enterprise valuation. Since 2019 he has also been a member in the Business Valuation Standards Board of the International Valuation Standards Council (IVSC). Wolfgang Ballwieser is the author of numerous publications about accounting and enterprise valuation and has a broad range of practical experience in both fields.

Bernhard Schwetzler is a Senior Advisor to ValueTrust Financial Advisors as well as professor at the chair of financial management at the HHL Leipzig Graduate School of Finance. He is chairman of the expert groups “Corporate Transactions and Valuation” and “Fairness Opinions” in the German Association for Financial Analysis and Asset Management (DVFA). On his Youtube channel „Questions of doubt in corporate valuation“ he provides information on topics related to company valuation.

Olaf Hoffmann is a Senior Advisor to ValueTrust Financial Advisors as well as CEO and president of Dorsch Holding GmbH and shareholder in the “Dorsch Group”. He has also been a member of the board of directors as well as the presidium of the Arab German Chamber of Commerce and Industry (Ghorfa) since 2009 in which he has also been the vice-president since 2012.

Sina Afra is a Senior Advisor to ValueTrust Financial Advisors and Serial Entrepreneur. His latest endeavor is Evtiko.com which he founded and serves as CEO. Before that he was the Founder of Markafoni, the first Online Fashion site of Turkey. Markafoni became also the first Turkish internet company expanding beyond the borders of Turkey. Mr Afra worked previously for more than 5 years for eBay and for KPMG for more than 12 years. He is an active business angel who has received several awards and invests in start-ups. He is the President of the Entrepreneur Foundation, Endeavor Turkey Board (2013-2017) and TÜSİAD Board Member.

Dr. Gerhard Killat is a Senior Advisor to ValueTrust Financial Advisors and ParkView Partners. He was a Director and member of the Management Board at Lazard & Co. GmbH in Frankfurt, from which he retired at the end of 2015. Before joining Lazard, he held positions as a Director at Merrill Lynch and Deutsche Bank in Frankfurt.

COOPERATIONS

ValueTrust and HHL Leipzig are working together on academic studies, such as the first German study on the systematic analysis of takeover bids and delisting strategies (“taking private study”).

www.hhl.de

ValueTrust is represented by an honorary professorship for “Practice of Transaction-Oriented Valuation and Value-Oriented Management” at the LMU Munich.

www.uni-muenchen.de

ValueTrust is sponsor of the quarterly “Finexpert-Report” of FINEXPERT GmbH. The report contains current capital market data, e.g. valuation multiples, yield curves and beta factors.

www.finexpert.info

ValueTrust and the Vienna University of Economics and Business jointly conduct academic studies, such as a study on the Austrian transaction and capital markets.

www.wu.ac.at/en

Since 2012, a member of ValueTrust’s management has been co-editor of the Handelsblatt’s Jahrbuch Unternehmensbewertung.

www.handelsblatt.com

The management of ValueTrust is a member of the editorial board of the trade journal Corporate Finance.

www.cf-fachportal.de

MEMBERSHIPS

ValueTrust is partner of the Valuation Research Group (VRG), the international partner network of Valuation Research Corporation (VRC), a leading provider of independent valuation support in the USA.

www.vrg.net

ValueTrust is a member of the Munich M&A Forum e.V. association and sponsor of the Munich M&A Forum, which takes place every six months.

www.mma-forum.eu

The CEO of ValueTrust is a personal member of the DVFA. In the working group Corporate Transactions & Valuation he contributed to the “Best Practice Recommendations on Corporate Valuation” and to the “Principles of Fairness Opinions” as a member of the DVFA Expert Group Fairness Opinions.

www.dvfa.de

ValueTrust employees are members of the European Association of Consultants, Valuators and Analysts (EACVA)-Germany, whose founding members include ValueTrust’s Chairman of the Board.

www.eacva.de

ValueTrust ist Sponsor des GCC-Germany Business and Investment Forums und des Arab-German Business Forums der Ghorfa Arab-German Chamber of Commerce and Industry e.V.

Die Geschäftsleitung von ValueTrust ist Mitglied der Expertengruppe “Investments”.

www.ghorfa.de

ValueTrust is licensed as a fairness opinion preparer for public takeovers and mergers in the Swiss market.

www.takeover.ch

The Chairman of ValueTrust is a member of the Association of University Teachers for Business Administration (Verband der Hochschullehrer für Betriebswirtschaft e.V.).

www.vhbonline.org

ValueTrust is a member of the Schmalenbach-Gesellschaft für Betriebswirtschaft e.V.

www.schmalenbach.org

GLOBAL NETWORK

ValueTrust is partner of the Valuation Research Group (VRG), the international partner network of the Valuation Research Corporation (VRC), a leading provider of independent valuation support in the USA. VRG furnishes expert and independent opinions of value for clients in more than 60 countries. Multinational engagements are managed locally by a single point-of-contact and executed by professionals located in respective countries. www.vrg.net

The VRG affiliates are located in the following countries:

|

|

|

||||

|

|

||||